The world is hungry for energy. Decarbonization and electrification require sharp decreases in fossil energy production, and a consequent increase in production from renewable energies. But sun and wind are unpredictable, while national grids require a stable reliable source to maintain equilibrium. The obvious answer has always been nuclear, but safety concerns and a considerable amount of misinformation have slowed down the adoption of nuclear worldwide.

Things, however, appear to be changing. First, because the new small modular reactors (SMRs) approach promises to partly solve both safety and cost issues; and secondly because geopolitical conditions require energy security in a world where alliances shift faster and single countries need to develop their independence strategy in different conditions today.

The best indication that we may be entering a renewed nuclear spring comes from the recent analysis by the Nuclear Energy Agency (NEA), which shows that projects to develop SMRs exist in almost all regions of the world, including in emerging economies, to serve a wide variety of purposes. The ongoing NEA analysis is part of an effort to monitor and evaluate the progress of various SMR designs towards first-of-a-kind deployment. The aim is to help policymakers, regulators, investors, industry professionals and others navigate a period of rapid change in the nuclear energy industry. The latest results of this work are published in the third edition of the NEA Small Modular Reactor Dashboard ¹, which was released in July 2025, along with a new interactive online tool, the NEA Small Modular Reactor Digital Dashboard, (@) which provides readers the ability to access and visualize the database directly online.

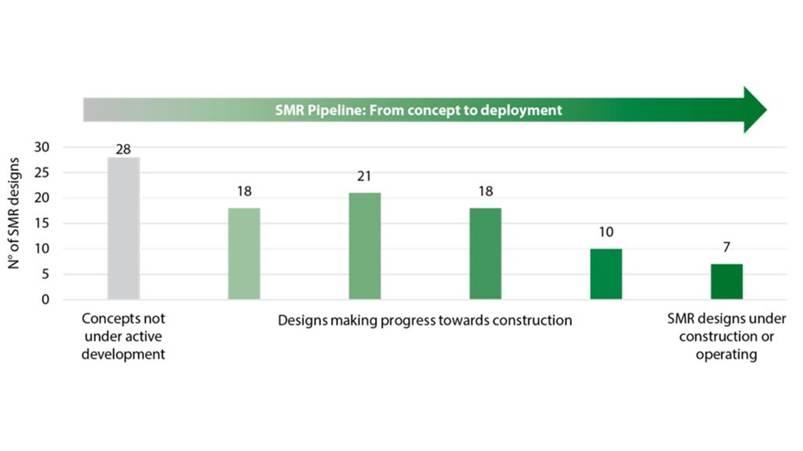

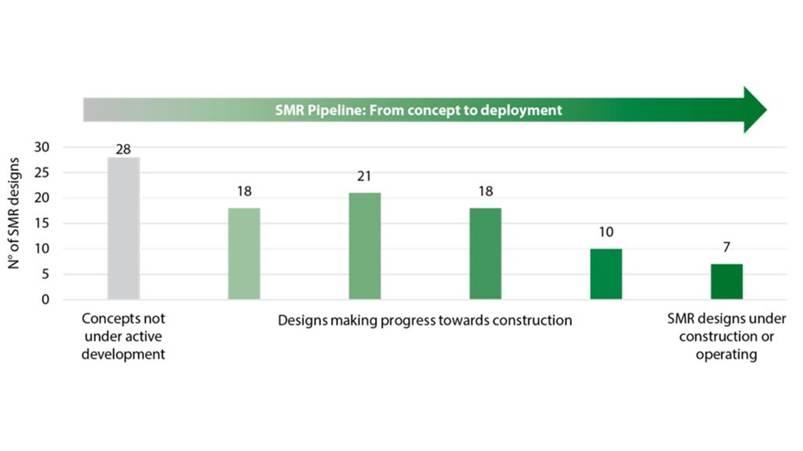

A total of 74 SMR designs were analyzed in the latest report, out of 127 identified globally. These 74 were the designs for which there was enough publicly available information to assess and whose designers were willing to participate. The analysis, as in previous editions, focused on progress made in licensing, siting, financing, supply chain, engagement, and fuel.

In terms of geographic location, Fig. 1 shows how work on SMRs is truly global. Some seven designs are either already operating or under construction (Fig. 2) and there is a strong pipeline of projects progressing toward first-of-a-kind deployment.

Of the 74 SMR designs assessed by the NEA, in 2025, 51 are involved in pre-licensing or licensing processes across 15 countries, and there are approximately 85 active discussions between SMR developers and site owners worldwide. Progress has also been made in financing and supply chain readiness, with an 81% rise in SMR designs confirming financing announcements since the previous edition of the Dashboard, published in 2024. This influx of capital is catalyzing progress in supply chain development and early-stage manufacturing capabilities.

The range of technical characteristics – including the concepts, configurations, neutron spectrums, sizes, and temperatures – enables SMRs to broaden the traditional market of nuclear energy. Some SMR designs may be particularly suited to provide heat to industrial sectors, such as chemical production or oil and gas extraction, where reducing carbon emissions is particularly difficult. Other SMR designs may be better suited to provide reliable electricity production in remote or offshore locations. Some technologies may also be used specifically for non-power applications, including to produce medical isotopes or to reduce or recycle radioactive waste.

Unlike traditional large-scale nuclear power plants, SMRs are also attracting particular interest from the private sector, with a vibrant startup culture around their development and interest growing among large corporations, particularly in technology and heavy industry, to support energy-intensive activities like datacentres. While most potential SMR sites (49) are still associated with utilities and government-owned entities, 11 are connected to private industrial players exploring SMRs as sources of clean, reliable power and heat. The United States is home to the greatest diversity of types of site owner, reflecting a broad spectrum of stakeholders now engaged in SMR deployment. SMR projects are increasingly being considered for siting near industrial or commercial centres, or near retiring coal plant sites. Ownership structures are also evolving, with some vendors exploring build-own-operate (BOO) models, power purchase agreements (PPAs), virtual power purchase agreements (VPPAs), or leasing arrangements, rather than relying solely on utilities as owners and operators.

Different countries are positioned to capture different types of benefits by participating differently in SMR global value chains. In the United States, France, the People’s Republic of China (China) and Russia, the majority of SMR-related supply chain activities support SMR designs that have headquarters within those countries. In contrast, in the United Kingdom, Canada, and Italy, most SMR-related supply chain activities support SMR designs developed by organizations headquartered abroad.

The path to this Nuclear Renaissance of course has many hurdles to face. Among them are:

Project qualification

Site identification and qualification

A “nuclear-class” certified supply-chain and workforce

Clearly the demand-side pull for these technologies will have to be strong enough to pull a widespread deployment in the coming years, but we will show in this blog that Artificial Intelligence can be of great help in the resolution and overcoming of these obstacles.

(@) NEA (2025), NEA Small Modular Reactor Dashboard, OECD Publishing, Paris, https://www.oecd-nea.org/jcms/pl_73678/nea-small-modular-reactor-smr-dashboard